Can you get refunds from GSA SmartPay?

Can GSA maximize refunds?

About this website

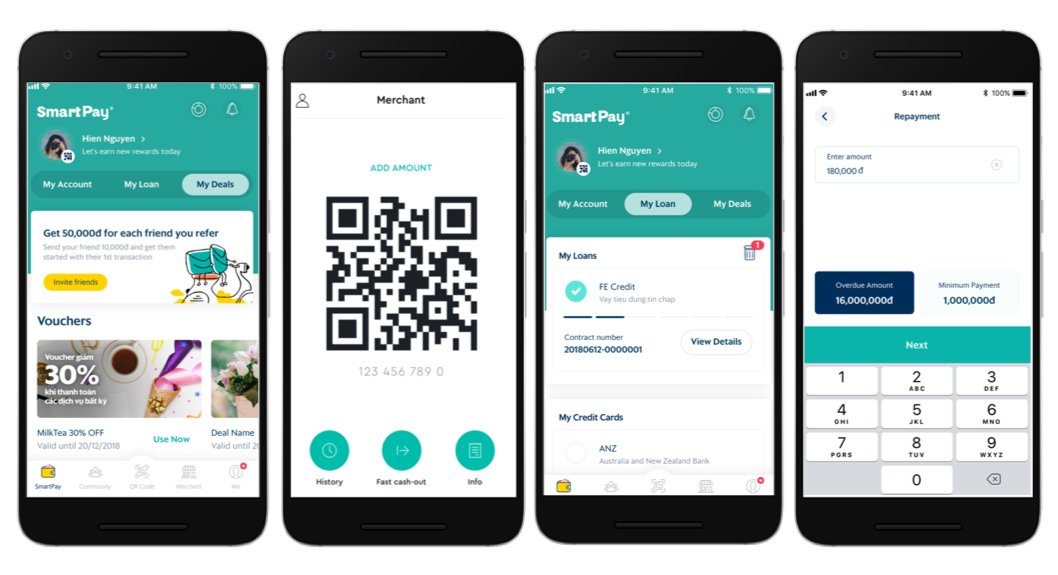

Can I return my SmartPay phone?

SmartPay Support Yes. You may return your device as long as it is within the retailer's return window. Please contact the retailer for instructions on returning the device.

How do I cancel SmartPay?

You may cancel your subscription by texting STOP to 57936. Service will continue until customer cancels. Carriers are not responsible for delayed or undelivered messages.

What happens if I dont pay SmartPay?

When a scheduled payment fails, our system will make further attempts to collect the payment, either in full or partial amounts until your lease payments ... Can I use a credit card to make my monthly payments for SmartPay? Yes, you can use a credit card to make your payments.

Does SmartPay affect your credit?

Yes. We use alternative credit reporting agencies to verify your personal and financial information. As with any credit application, it's important to be as accurate as possible when completing the SmartPay application. This type of verification may appear as an inquiry on your credit report.

Is SmartPay safe?

I was cautious about the security aspect of linking a mobile transaction to my checking account, but the app is PIN protected, and location based. The entire process is highly secure, but it's also true that most of the public still prefer to pay for gas with their favorite airline, hotel, or cash-back credit card.

How much interest does SmartPay charge?

3.5% to 20%A fee of 3.5% to 20% may apply based on your plan.

Can SmartPay sue you?

Yes, SmartPay Leasing LLC can sue you. SmartPay Leasing LLC can hire a lawyer to file a breach of contract lawsuit against you for the underlying debt, fees, and costs.

What phone companies use SmartPay?

Popular phone carriers that use SmartPay leasing include:Net10.Total Wireless.Boost Mobile.Simple Mobile.Straight Talk.Page Plus.

Can I use smart pay at Walmart?

0:051:25How To Use Walmart Pay - YouTubeYouTubeStart of suggested clipEnd of suggested clipType note that you have a qr code as an option open your walmart.MoreType note that you have a qr code as an option open your walmart.

What credit score do I need for SmartPay?

a 620 estimatedStart Saving More With SmartPay Financing not available for customers with less than a 620 estimated credit score. Flexible terms with low payments that fit your budget. Financing not available for customers with less than a 620 estimated credit score. Return or upgrade your items at anytime without penalties.

Who owns Smart Pay?

Headquartered in San Francisco's Financial District, SmartPay Leasing is a subsidiary of TEMPOE, a specialty finance company based in Cincinnati.

What happens if you don't finish paying off a phone?

Your mobile provider could cut your phone off so you're unable to make or receive calls. If you don't take steps to deal with the debt, your account will default and the contract will be cancelled. The mobile provider can then take action to recover the outstanding bill, following the normal debt collection process.

Can you cancel a SmartPay Lease?

SmartPay customers may end the Lease-to-Own agreement at any time. But they must return the phone to SmartPay. Please refer to customer agreement materials. Customers can also call SmartPay at 800 374 5587 or email support@smartpaylease.com.

How do you stop automatic payments?

How do I stop automatic payments from my bank account?Call and write the company. Tell the company that you are taking away your permission for the company to take automatic payments out of your bank account. ... Call and write your bank or credit union. ... Give your bank a "stop payment order" ... Monitor your accounts.

How do I stop automatic payments on my credit card?

To stop the next scheduled payment, give your bank the stop payment order at least three business days before the payment is scheduled. You can give the order in person, over the phone or in writing. To stop future payments, you might have to send your bank the stop payment order in writing.

How do I contact SmartPay?

You can change your primary payment method by logging in to your SmartPay account. If you need assistance, you can also call our customer support at 925-298-6109 which is open 7 days a week from 7 am to 7 pm PST Monday through Saturday and 7 am to 5pm PST on Sundays.

Lease with SmartPay

All personal and payment information provided in the application must belong to you.

MAKE YOUR PAYMENTS

During the SmartPay application process, you will be asked to provide a credit or debit card to be used for your initial payment. SmartPay will automatically charge this card for all future scheduled payments, according to your lease’s payment schedule. Subsequent monthly payments may not be made in store.

YOUR ACCOUNT

Log into your SmartPay account via our Consumer Home portal here. You will be prompted to activate your account if you have not already. Once logged in, you will be able to view your lease agreement on the “Order Details” section of the “Your Plan” tab.

PARTNER WITH SMARTPAY

SmartPay lets you grow your sales by providing honest and transparent leasing for your customers, so they can get the devices they love. We pay you upfront for all leased items and handle all subsequent payment collection, eliminating all risk to you from our leasing process.

What does SmartPay mean?

This means that the account holder’s responsibilities do not end when an item they purchased is inspected and accepted. The purchased item must be properly accounted for in accordance with applicable federal and agency policies and regulations.

What is a merchant's return policy?

Return policies can vary by merchant. Merchants are responsible for establishing their own return and adjustment policies with their customers. If the return policy is unclear when making a purchase, please ask the merchant for clarification to avoid future misunderstandings. Merchants are required to disclose their return policies to the customer before the completion of a transaction.

Information We Collect & Share

Information you provide during the application process and on forms, including your name, date of birth, address, telephone number, email address, employment information, income, marital status, gender, Social Security number or Taxpayer Identification Number, driver’s license or other government-issued identification, and account credentials;

Communication From Us

By agreeing to this Policy, you give us consent to contact you at the mailing address, telephone (cellular or landline) number, text/SMS number, email address, or fax number that you provide during the lease application process or that you provide to us thereafter.

How We Use Information

To provide our services, including to process lease applications, lease merchandise, and receive payments;

With Whom We Share Your Information

We do not share, sell, rent, or trade your Information with any third party except as disclosed within this Policy, any other agreement you have with SmartPay, or with your consent.

Do Not Track Notifications

Some web browsers may allow you to transmit “do-not-track” or similar signals to the websites that you visit. Our website does not respond to web browser’s do-not-track signals, and we do not alter our behavior or change our services upon receiving a do-not-track request.

Data Retention

We will retain your Information for as long as we have a legitimate business purpose to do so. If you wish to cancel your account or request that we no longer use your Information, contact us at support@smartpaylease.com.

Our Security Procedures

We limit access to Information about you to those third parties who we believe have a legitimate business purpose to access such Information. We maintain physical, electronic, and procedural safeguards that comply with or exceed federal standards to keep Information about you safe.

Connect In Style

Instant approval gets you the phone that best matches your needs. What features do you value most?

Shop With SmartPay Online

Choose the device, plan and accessories that fit your needs and budget.

How long do you have to return a defective item?

If the goods are NOT defective and you wish to return them you have 7 days from when the package arrives to return the goods for a refund. All returned merchandise must be in complete original manufacturer's packaging, same condition as sold, with all literature, accessories, instructions, blank warranty cards and documentation.

How long does a phone need to talk to be returned?

All Phones must be returned in "Like-New Condition", show no signs of use and must have less than 25 minutes in total cumulative talk time. If an item is defective it may only be exchanged with an equivalent product if we are unable to supply the same item or if the item cannot be repaired.

How long does it take to get a refund from PayPal?

Refunds will be issued to the original payment method (s) and may take 3 to 5 days to post to your bank or PayPal account after the return has been processed.

What is the phone number to call for a return?

If you need assistance with your return, please give us a call at 1-800-461-8898. This is recommended for more complicated returns – for example, if your item is damaged, if you'd like to make an even exchange instead of a return, or if you received an item as a gift.

Can you get refunds from GSA SmartPay?

Refunds. In addition to saving money by paying no direct fees for using GSA SmartPay solutions, customer agencies and organizations have the opportunity to earn refunds. Refunds earned can and have been used by customer agencies to directly fund and support efforts critical to their mission.

Can GSA maximize refunds?

Agencies can maximize refunds earned by migrating spend from convenience checks, personal payment (e.g., cash or personal credit card), and traditional contract payment to GSA SmartPay payment solutions.